We create value through an active management approach:

We create value through an active management approach:

Through modeling of the markets where we invest, we can better choose the strategies that will most probably generate superior results at each moment, a capacity we use both on direct and on indirect investments. Knowing the correct timing to engage in a retrofit or in a development, to make a rent revision, or even to support the decision of entering a specific global market, often contributes to obtain returns significantly above market average. See our analytical approach.

On the direct investments, each property is treated as a company with its unique business plan, carefully developed and refined during the acquisition process. Some examples of actions like these are: targeted investments that generate direct impact in rental growth, conversion of building cost centers into profit centers, condominium restructuring of accounts, creation of new services to tenants, management of surgical revision procedures in line with our projections of rents.

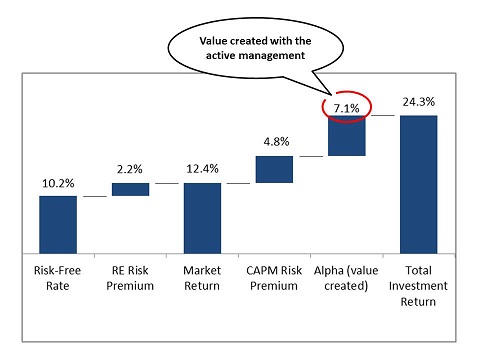

And how do we measure the delivery of results? We understand that the return of an investment is composed of distinct parts that must be identified and measured separately. Only then it is possible to demonstrate, in a transparent way, if the performance was achieved only because of an increased investor’s exposure to risk, a bull market period or if a result of real value creation by the asset manager.

We benchmark our funds’ performance with the market’s using the appropriate index for each case. In addition to identifying the “alpha” created versus the market index, we describe and quantify the financial value created on each stage of our management performance.

Below we illustrate, as an example, the building blocks of the internal rate of return (IRR), before capital gain taxes, of investments under our management by the team members in the past:

In this example, benchmarked against an index called IGMI-C issued by FGV (a real estate index similar to the IPD), out of the 24% IRR delivered to the investors, our management added 7% above the market average return adjusted by the portfolio volatility (a 2.1 beta calculated using the CAPM methodology).